Please wait...

This is an event produced by Southbank Investment Research Ltd. Your capital is at risk when you invest, never risk more than you can afford to lose. Seek independent advice if you're unsure of the suitability of any investment. Forecasts and simulated past performance are not reliable indicators of future results.

Paolo Cabrelli

Publisher, Southbank Investment Research

It’s a deeply uncertain time to be a British investor - let alone a retiree.

It doesn’t matter if your money is in stocks, bonds, gold or even property…

Rampant inflation- the rising cost of just about EVERYTHING - has very likely left you worse off.

As a knock on effect…

Experts are predicting a “terrible reckoning” in the housing markets as mortgage rates soar…

And real interest rates - a former safe haven for conservative savers - are still in the negative.

Worse, it doesn’t look like things are going to get better any time soon…

With Britain's debt bill now BIGGER than our GDP - for the first time in 62 years…

And research by the Institute for Public Policy Research predicting we’re stuck in a “doom loop” of no growth and no investment… with no foreseeable way out.

If you’re waking up to the notion that a private pension on its own probably won’t be enough…

If you’re looking for a chance to enhance your wealth-building, whether the market goes up, down or sideways…

You’re in the right place.

At 2pm on Thursday 13th July, we’re going to walk you through a completely novel method of wealth accumulation.

We call it the ‘Active Capital Booster’.

In our free-to-air, online broadcast…

You’ll discover a conservative approach to growing your nest-egg, designed to snowball over the long run.

No risky leveraging.

No hit-and-hope shorting.

Nothing complicated at all.

Anyone with an account at an online broker can use this method.

It is designed specifically for ease and simplicity.

And to help add some confidence and consistency to your trading life:

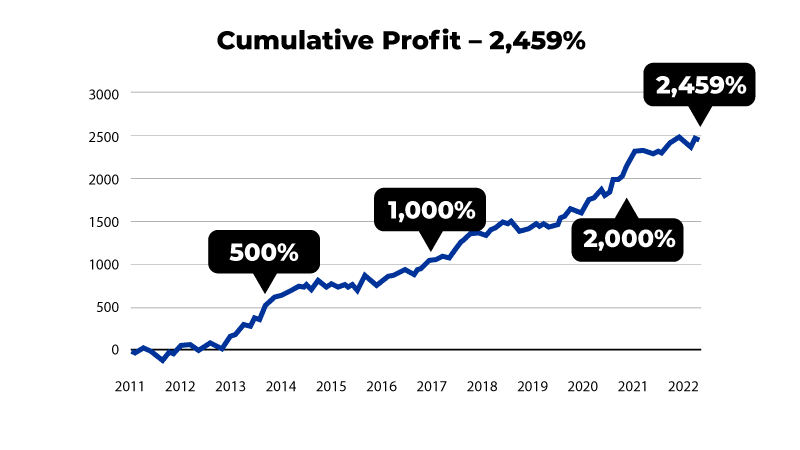

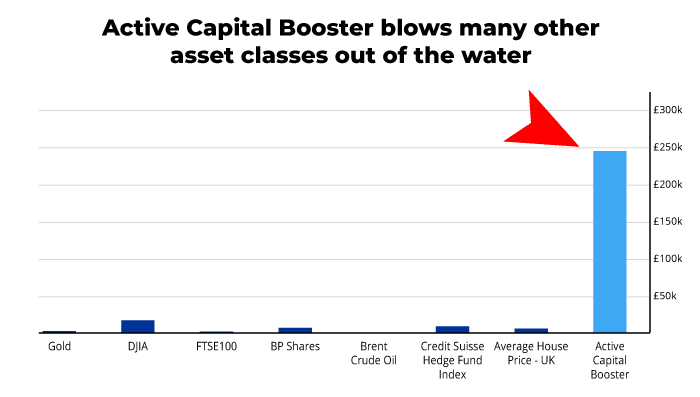

Figures refer to back tested results, and simulated past performance is not a reliable indicator of future performance. (to 31 August 2022 – without accounting for costs or taxes)

To the ‘Active Capital Booster’ strategy aims to make a real, tangible difference to your nest-egg…

In fact, our extensive back-testing shows that over the 10 years to 31 August ‘22, you would have quietly and consistently stacked up 2,459% in cumulative gains.

Figures refer to simulated past performance and past performance is not a reliable indicator of future performance.

Steadily turning a £10,000 starting pot into hundreds of thousands of pounds.

Not swinging for ‘big hits’ of 100% or 500%...

Instead, focusing on the smaller, achievable moves of 5-8% that stocks make all the time.

Pocket that win. Then move on…

Accumulating profits, as you go. That’s the method.

Best of all, for anyone currently anxious about the uncertain nature of the markets - and the UK economy in general - right now…

Our system has a tight stranglehold on risk.

By allocating just half-a-percent of your growing pot on each trade, you’re only ever taking a very small risk on the one hand…

And on the other, exposing yourself to the extreme wealth-building power of compounding.

In the event, we’ll talk you through how risking the same small percentage of a growing pot per trade could super-charge your pot over the long-run.

Described by Einstein as ‘the most powerful force in the universe’… we’ll show you how it could seriously power-up your long-term wealth accumulation.

Of course, this is short-term trading. There’s no leverage, but it’s still risky – more so than simply buying and holding gold or the FTSE 100.

Your capital is always at risk when you’re trading. As with any system, some trades will close at a loss. That’s a fact of life when you trade or invest.

The golden rule: only ever trade with or invest money you can afford to lose.

You must understand and be comfortable with the risks involved before committing any money to investing. Join us at 2pm on Thursday 13th July and watch our exclusive ‘Active Capital Booster’ walkthrough. It’s free, but only if you register now:

According to our back-tested data… had you been using this method over the last decade (from 2011 to August 2022), your yearly cumulative returns would look like this:

| YEAR | CUMULATIVE PROFIT |

|---|---|

| 2011 | 4.7% |

| 2012 | 70.7% |

| 2013 | 557.7% |

| 2014 | 117.5% |

| 2015 | 19.6% |

| 2016 | 178.9% |

| 2017 | 412.1% |

| 2018 | 30.8% |

| 2019 | 254.3% |

| 2020 | 334.7% |

| 2021 | 389.3% |

| 2022 (to end of Aug) | 89.3% |

To reiterate: That’s a total: 2459.6% cumulative PROFIT.

Figures refer to simulated past performance and past performance is not a reliable indicator of future performance.

Some good years.

Some great years.

And while you WILL see losing trades, like any strategy, you’ll note that our back tested data shows not a single losing year.

Every year came out, overall, in profit.

And since we started sharing this system with a small group of Southbank members back in October 2022… real investors, in real world conditions…

I’m delighted to report that it has performed just as we expected. The satisfying upward curve continues.

This system really is the ‘complete package’.

It’s easy to follow.

You’ll get buy signals AND sell levels, delivered by email or via our app, so you can pick them up on the move.

Plus, you’ll get a specific stop loss and price target.

Forecasts are not reliable indicators of future results.

It’s all done for you.

If things go to plan, all you’ll need to do is place the trades… and steadily watch your account grow.

Count yourself in:

You’re living through the worst time in living memory to be an investor - in Britain.

Inflation is still riding high at 9%. With forecasts saying Britain will be the highest out of all advanced economies in 2024.

Rates have just been increased to 5% - with the only compensation offered to struggling mortgage payers and borrowers from the Bank of England being a paltry “We know this is hard” .

That puts a huge hole in your finances – one that it’s crucial you fill if you’re going to avoid falling behind.

The wider stock market doesn’t seem to have the answer. The FTSE 100 is right where it was 5 years ago.

Half a decade treading water. No good.

And to make matters worse, the pound is still struggling against the dollar - down 10% from where it was 2 years ago.

On top of THAT… the private pension industry needed a BAILOUT to stay solvent. Could the ‘unthinkable’ happen?

Some of the recent correspondence from our members here at Southbank Investment Research tell me that long-term wealth security a growing worry:

Maybe you can relate to these messages. A lot of people feel this way. Confused, exhausted, out of options.

So what do you do?

Well, given the risks involved with stock trading I’m not here to promise you that I have the ‘golden bullet’.

But what I will say is that right now you HAVE to be open to exploring new ideas.

Bare minimum, you need to educate yourself on your options.

And if the back-testing we’ve been doing is anything to go by… our ‘Active Capital Booster’ could prove invaluable to your wealth-building in the years ahead.

That’s why we’d like to walk you through this new plan. We see a lot of promise in it – and think you will too.

All you need to do is to get your name down for our free ‘Active Capital Booster’ private webinar at 2pm on Thursday 13th July.

Just pop your email in the box below:

And here is an important point:

This is designed to run alongside your current pension plans.

I want to make that clear.

If you currently invest into a private pension scheme, there’s no compelling reason to stop.

Over time, it will very likely raise the level of your investment. Even if you may have taken a hit recently, a slow and time-tested pension will at least return something.

But a good tradesman has more than one tool in his toolbox. And when it comes to wealth-building, so should you.

That’s why we have designed this Active Capital Booster. Not to replace your current plan, but to provide the potential for an extra avenue of wealth generation along-side what you already have running.

Only ever using a TINY slice of your overall capital.

With patience and discipline, our research and back-tested data shows the results could be very meaningful indeed.

Beat the market? Over the DECADE to 31 August 22, our ‘Active Capital Booster’ would have crushed the market (in back-testing).

Figures refer to simulated past performance and past performance is not a reliable indicator of future performance.

If all of this sounds good to you, I need to make sure.

So…

I have a simple question:

Do You Qualify?

If you like the sound of this strategy… and are already thinking about how it could work for you…

There are key principles you have to be onside with, to get the most out of it:

Can you accept that all trading carries risk?

Can you accept that the days of a ‘set and forget’ portfolio seeing you through are probably over?

Can you accept that you will have to be comfortable buying and selling stocks more frequently than you are used to?

Can you accept that to limit the risks, you’ll need to apply our careful risk reduction strategy?

Can you accept that you’ll have to show discipline – and confidence – in the system to maximise the potential?

Finally….

Are you ready to embrace a new approach to potentially accelerate your retirement wealth building?

If you can honestly answer ‘YES’ to those questions, this may very well be the plan you have been looking for….

Just enter your best email in the box below and at 2pm on Thursday 13th July, we’ll walk you through it – and show you how to get it working FOR YOU:

You may be reassured to know that this system has been 20 years in the making:

Adrian Buthee – One of the UKs leading trading trainers

In our broadcast, we’ll be joined by Adrian Buthee.

Over almost two decades, Adrian has been showing UK traders and investors how to use effective strategies to improve their financial lives.

Based here in the UK and in Hong Kong, Adrian has a team of veteran traders, mathematicians and developers, honing trading systems that can deliver.

His team have won multiple awards for their trading training and, very soon, he’s going to run you through what could be their most impactful method yet.

At the start of 2022, the wind of change was in the air. Markets were clearly turning and it was apparent that inflation and volatility was here to stay.

So, I tasked Adrian with fine-tuning his trading algorithm to focus on consistency… to zoom in on the more probable, achievable trading targets.

Months of testing and back-testing provided us with all the confidence we needed.

And we’d like to show you how it works – and offer you the chance to apply this method to your own wealth building.

If that sounds good to you, ensure your name is on our list:

Many thanks,

Paolo Cabrelli

Publisher, Southbank Investment Research

PS. Just for signing up, we’ll unlock a special series of primer content so that you can hit the ground running when we go live on Thursday 13th July – at 2pm.

That includes an exclusive interview with one of the creators of this unique method… and a specially produced starter’s guide on the key principles behind this strategy.

You’ll walk away a more knowledgeable investor and with something valuable in your back pocket.

All of that is yours – but only if you are on our private viewing list:

Simulated past performance is not a reliable indicator of future results.

Figures refer to simulated past performance and past performance is not a reliable indicator of future performance.

To register your place for our free wealth-accumulation webinar, just enter your email in the box below.

We’ll confirm your place by return email. You’ll receive a private viewing link 30-minutes before the broadcast goes live at 2pm on Thursday 13th July: